Market Update

Markets posted a strong rally in the first half of Q3 on the hopes that the US and Canadian Federal Reserves may begin to slow their rate hike cycle as the data began to show signs that inflation had peaked. This speculative optimism was quickly squelched after US Fed. Chair Jerome Powell said in no uncertain terms during his Jackson Hole symposium speech that we have to accept “a sustained period of below-trend growth” to reduce inflation — prioritizing long-term economic health over the lure of short-term gains.

A great deal of the volatility investment markets have experienced this year, while rooted in the very real economic implications and aftermath of the pandemic, has been largely the result of speculative trading based on superficial interpretations of the macro-economic issues we have discussed here over the last nine months. It is this same behavioural tendency for investors to speculate on the news headlines of the day and subsequently make knee-jerk investment decisions based on it that ironically presents some of the best buying opportunities for prudent long-term investors. Human evolutionary instincts are such that when something is threatening us, experience tells us to get away as quickly as possible. This is a prudent reaction when dealing with bears, avalanches and hurricanes, but it is not so helpful when it comes to investing.

In order to achieve long-term success in investing, we need to remind ourselves that when you buy a stock, you are buying a business and not just a ticker symbol whose price fluctuates second by second based on the sentiment of the market in that moment. Ultimately, investing in a portfolio of well managed businesses not only preserves capital but over longer periods of time, provides the opportunity for tremendous wealth creation.

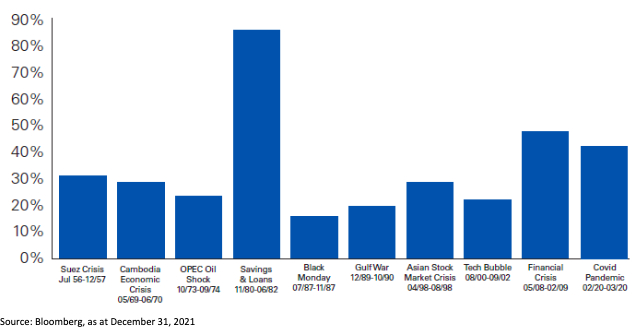

Markets bounce back. When markets drop, our first instinct may be to sell immediately. But that’s often the worst thing to do. In fact, by the time we are feeling that urge to sell, it is probably already too late to limit the damage. And we know from history that the period right after a significant market decline is often the most profitable. We have spent a great deal of time this year talking to portfolio managers and their teams about how they plan to navigate their portfolios through these economic conditions and consistently we find that they are buying more of the stocks they believe in. These are often positions that were already held within the portfolio before a downturn but now those same stocks are bargains and they want to buy more. This is because experienced long-term investors know that when the market recovers, it is often in vigorous fashion, as seen in the chart below.

A year after a crisis, markets have been back up an average of 33%

The chart below shows the S&P/TSX Composite Index total return 12 months after hitting bottom as a result of a significant geopolitical or economic crisis.

Please find below some additional resources using historic data to highlight the potential upside opportunity that exists for a prudent investor coming out of previous significant market corrections.

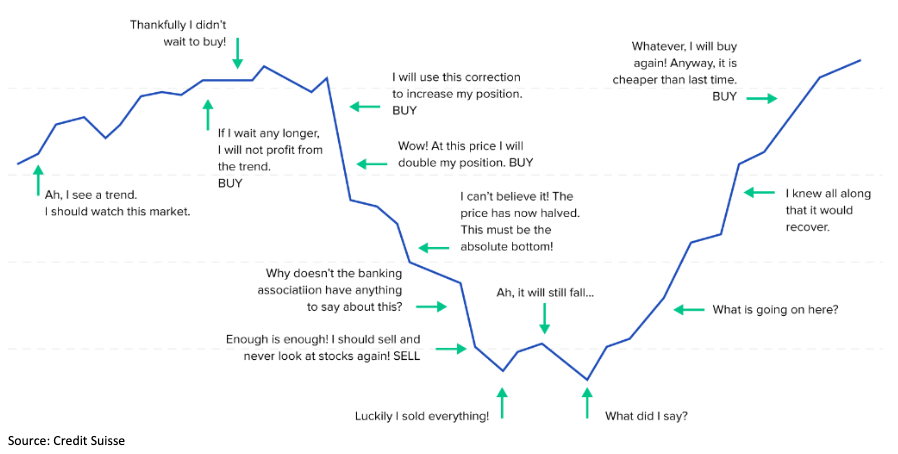

In the investment process, investors often experience the “roller coaster of emotions”, illustrated below. Does this look or feel familiar to you?

If so, you are not alone. Melissa Lin is a management consultant who has worked with Fortune 500 companies across multiple sectors and says that “After all, the cyclical investment process, which includes information procurement, stock picking, holding, and selling investments, followed by making a new selection, is full of psychological pitfalls. However, only by becoming aware of and actively avoiding behavioral biases can investors reach impartial decisions.”

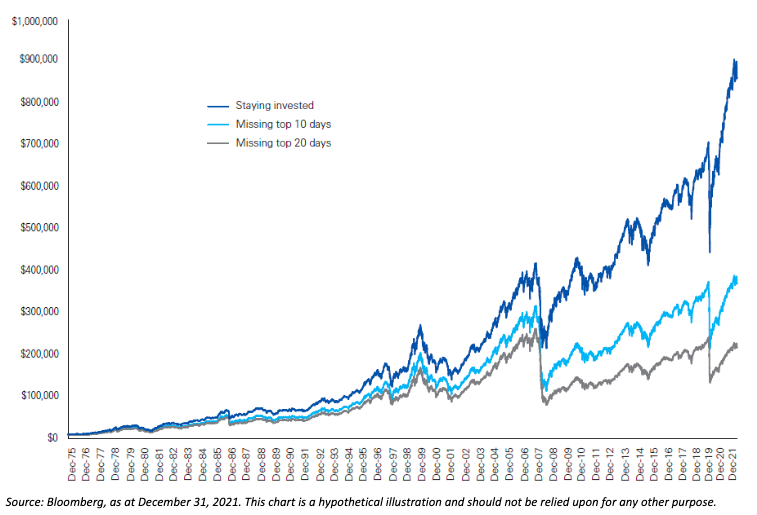

By selling when your investments are dropping, you’re locking in a loss and missing the possible run up to pre-decline or higher prices. Selling in and out of the market based on fears and optimism will likely mean you’ll be sitting on the sidelines on some of the best days. The chart below illustrates the potential effect.

Cost of missing the best 10 days on the Toronto Stock Market

S&P/TSX Composite Index CAD – growth of $10,000

As legendary economist and investor Benjamin Graham famously said, “The investor’s chief problem—and even his worst enemy—is likely to be himself”. As always, we are here to help so please do not hesitate to reach out if you would like to discuss your personal situation. We welcome the opportunity to review your needs and provide you with the tools and resources you need to make informed financial decisions with confidence.

Paul & Conor

Updates

In case you missed them:

Please find below some of our recent e-mail communications for more information on the current state of markets and the potential impact on your portfolios.

- “A Storyline to Consider” – Sent Sept 29, 2022

- “Administrative Update” – Sent Sept 19, 2022

- “Things to consider when reviewing your statements” – Sent June 30, 2022

Year-End Planning:

As we look toward the end of 2022, we would like to share some year-end financial planning considerations to help ease your mind and allow you to focus on the year ahead. Please feel free to contact our office if you wish to discuss any of these items in more detail or see how they relate to your own financial planning.

- RRSP contributions – Review your 2021 Notice of Assessment and consider making a contribution now to reduce your 2022 tax liability.

- TFSA contributions – The annual contribution limit for 2022 is $6,000 and the lifetime contribution maximum is $81,500 for anyone born in 1991 or earlier.

- RESP contributions – The annual contribution limit per beneficiary is $2,500 in order to receive the maximum available grant money (CESG) of $500. However, if you did not contribute the maximum in a previous year(s), you can make up for unused CESG one year at a time (an additional $2,500 in contributions and $500 CESG). This is especially important for anyone with children turning 16 or 17 this year in order to maximize the available grants before the beneficiary is no longer eligible to receive CESG.

- Life & Health Insurance considerations – Your insurance needs are constantly changing based on any number of variables. It is important to review your needs on an ongoing basis to ensure your loved ones and other financial responsibilities are cared for in case of the unexpected.

- Beneficiary Designations – Review or update your beneficiary designations on registered plans and/or insurance policies to align with your estate wishes.

- Investment/Retirement Forecasting – Contact our office to learn more about our investment forecasting and income projection models. These tools are designed to give you a clearer idea of where you are today, where you could reasonably expect to be in the future based on your current investment strategy, and most importantly, how those assets can be used to meet income or other obligations down the road.

Our Client Service Promise:

The world has seen extremely difficult times since the outbreak of the global pandemic. Financial markets this year are perhaps now realizing the longer-term effects of what we have all been going through. As humanity has done so many times in the past, we will all get through this.

Within our firm we feel that one key aspect that has been lost and suffered during these times and in recent years is respectful, dignified, quality customer service. For our firm, each and every client is extremely important to us and it is in this spirit that we maintain our motto:

Your Family, One Office, You First™

We sincerely appreciate your trust and in order to emphasize out commitment to you, we have created “Our Client Service Promise”, a copy of which is attached to this email.

Click Here to see Our Client Service Promise on our website.